Estate Planning

The first step in estate planning is to get to know about you, your family, and your goals. This will be the focus of the initial meeting. We will provide you with a comprehensive questionnaire designed to aid with this important step, or you can download it from the Estate Planning Questionnaire section of this page. We will then meet to discuss your goals. I will often ask questions that will get you to think of what you would want to have happen in situations about which you might not have previously given any thought. The purpose is to make certain that what you intend is what gets into the final documents. Based on all of this, I will then discuss with you the different approaches that might be employed, get your thoughts on the different possibilities, and will then make my recommendation as to the estate planning documents that in my judgment best meet your goals. Some clients do not require any estate planning documents, and if that is the case, you will be advised of that, as well. The documents then are drafted and sent to you for review. After you have reviewed the drafts, the final documents are prepared and an appointment is set for you to come to the office to execute them. Various estate planning documents may be used. They include:

- Wills

- Trusts

- Durable General Powers of Attorney

- Durable Health Care Powers of Attorney

- Living Will

Wills dispose of a decedent’s property, but only the property that passes through probate. Wills are usually formal documents with formal execution requirements. They do not take effect until the person who signs one (called the “Testator”) dies. They are only valid if the Testator is at least 18 years of age, has testamentary capacity and is not acting under undue influence. In most instances, a Will is valid only if its execution is witnessed by at least two witnesses.

Trusts represent the separation of the legal title to property from the beneficial enjoyment. That is, the trustee holds legal title to property, but holds the property for the beneficial enjoyment of one or more persons referred to as beneficiaries. Trusts may be express or implied, revocable or irrevocable, and may be created under a decedent’s Will (“testamentary” trusts) or while the person is still alive (“inter vivos” or “living” trusts). Some trusts (usually revocable living trusts) are used to carry out much the same purposes as a Will, in that the person who creates the trust (referred to as the “Trustor” or “Settlor” or “Grantor”) may provide in the trust for the disposition of the Settlor’s property upon death. But such a trust may also be used while the Settlor is alive, a key distinction from a Will. Property that is in such a trust at the time of the Settlor’s death–or that passes to it pursuant to a beneficiary designation–does not pass through probate and so is not controlled by the decedent’s Will.

There are many variations of trusts used for many different purposes. They can be used to hold property for someone who is not capable of holding and managing assets, such as minor children. They can be used to hold assets for one person for a time but ultimately to distribute the property to someone else. For example, in a second marriage, one may desire to provide for the other for life, but then upon the other’s death, have the assets distribute to one’s own children.

An agent may be appointed to act on behalf of another, referred to as the principal. The powers given the agent may be very limited or quite broad. It is a “durable” power of attorney if it contains appropriate language that states it will stay in effect even if the principal subsequently becomes incapacitated, or if the governing statute so provides. If no agent is serving and one becomes incompetent, it may be necessary to have a guardian appointed. In many cases, having a valid durable general power of attorney in place can avoid this court proceeding.

A New Approach

New provisions enacted by the Montana legislature in 2007 have prompted us to develop a new approach to our estate planning documentation. We have been in the forefront of developing a method to use an unfunded inter vivos revocable trust (sometimes referred to simply as a living trust, or as a revocable trust) as the centerpiece of the estate plan. This is contrary to what had been the conventional wisdom, but is now being recognized as a good innovation. Employing this approach can allow you the benefits of continuing to hold all your assets in your own name, of avoiding probate (the common reason given for many who employ living trusts), and bringing centralized coordination back to your estate plan. My article outlining this method was published in the May 2011 issue of The Montana Lawyer, and received an award for the best article published over the prior year. You can read the article, A Second Look at Living Trusts, by clicking the link to it in the Estate Planning Articles section of this page, or here:

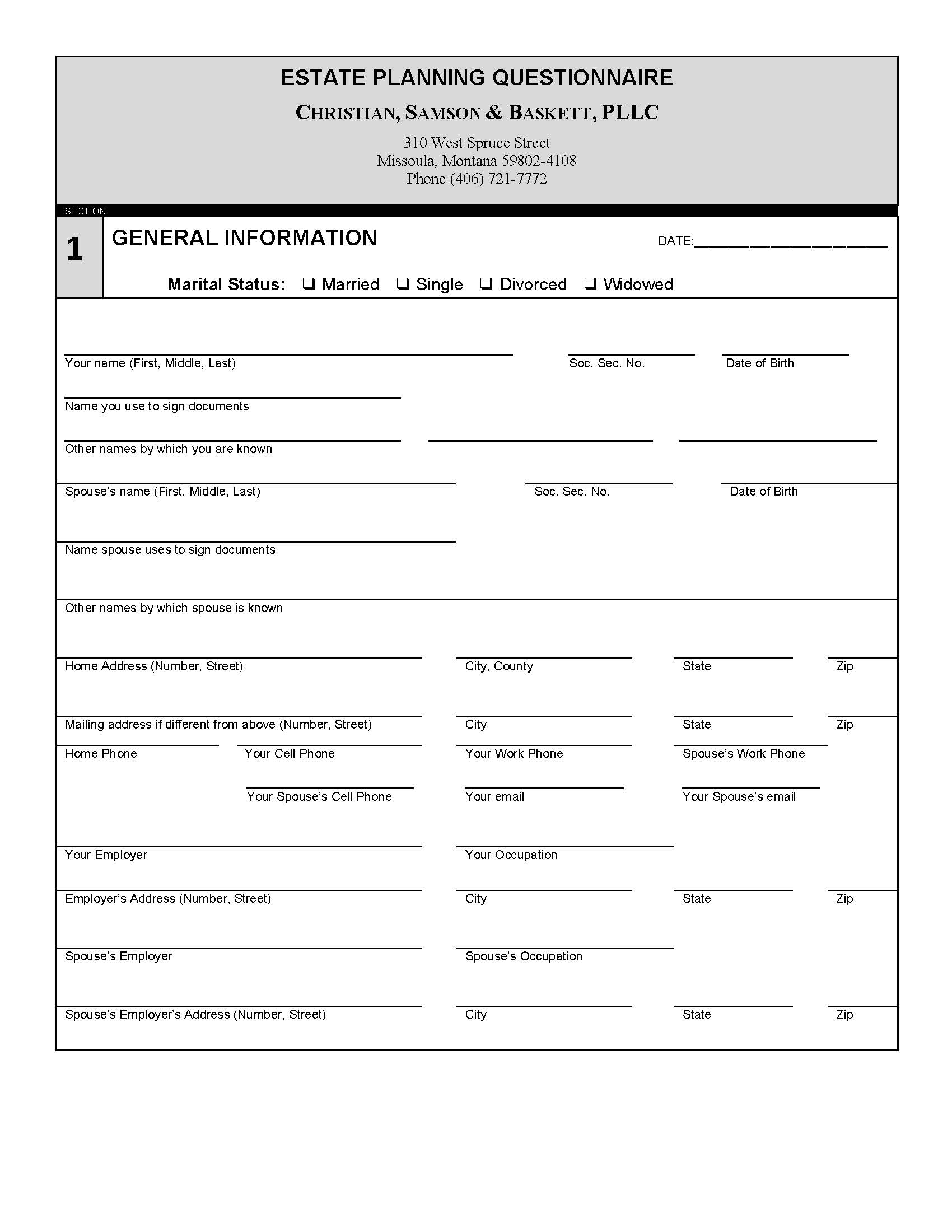

Estate Planning Questionnaire

You can complete my estate planning questionnaire online and submit it electronically at this Estate Planning Questionnaire link. Or you can click on the image below, download the paper version of the questionnaire and complete it by hand. Completing this prior to our first meeting will aid our discussion. Submitting the questionnaire does not create an attorney-client relationship.

Estate Planning Articles

Here are links to articles and outlines I have prepared on Estate Planning. (Caution: These have not been updated since they were written and consequently do not reflect any subsequent changes in the law.):

- Revocable Living Trusts (2013)

- A Second Look at Living Trusts (as published in the May 2011 issue of The Montana Lawyer and selected for the Haswell Award for best article of the year)

- A New Approach to Basic Estate Planning

- Selected Recent Montana Probate & Estate Planning Case Law (Nov. 2018)

- Montana Estate Planning Case Law- 2011 Update

- Recent Montana Cases Affecting Estate Planning

- Recent Montana Cases Affecting Estate Planning – 2007 Update

- Recent Montana Cases Affecting Estate Planning – 2009 Update

- Will Drafting – Annotated With Recent Montana Cases (2008)

- Planning for the Disabled Child by Use of Self Sufficiency Trusts

- Asset Protection Planning in Montana

- Marital Deduction Provisions in Wills and Trusts

- Intestacy Handout

- Elective Share Handout

Estate Planning Links

- IRS Tax Forms and Publications

- Montana Tax Forms

- MontGuides on Estate Planning Topics

- Montana End of Life Registry

- Social Security Online

- American College of Trust and Estate Counsel

- Institute for Indian Estate Planning and Probate

- CaringInfo.org Advance Directives

- Garn-St. Germain Act (preempting specified due on sale clauses)

MontGuides

These are publications of the Montana State University Extension Office that provide simple explanations of various topics of estate planning. The following is not a complete list of all their publications. For all of their publications, and to make certain you have the latest version of the MontGuides for the topics listed below, visit the MontGuides Website.

- Estate Planning in Montana: Getting Started

- Wills

- Revocable Living Trusts

- Beneficiary Deeds in Montana

- Power of Attorney

- Designating Beneficiaries through Contractual Arrangements

- Dying Without a Will in Montana Who Receives Your Property

- Who Gets Grandma’s Yellow Pie Plate? Transferring Non-Titled Property.

- Federal Estate Tax

- Glossary of Estate Planning Terms

- Gifting: A Property Transfer Tool of Estate Planning

- Property Ownership

- Estate Planning for Families with Minor and or Special Needs Children

- Letter of Last Instructions

- Medicaid and Long-Term Care Costs.

- Nonprobate Transfers

- Montana Rights of the Terminally Ill Act

- Montana’s End-of-Life Registry

- Personal Representative Responsibilities

- Settling an Estate: What Do I Need to Know?

- Montana Uniform Transfers to Minors Act (UTMA): Custodial Accounts for Children